What is the procedure for converting single entry bookkeeping to double entry bookkeeping?

Content

The cash book and journal should be used under the single entry system. The ledger is not generally used in this system, although it may be used to record the totals of certain account heads. Normally under the single entry system, only personal accounts are kept, whereas impersonal accounts are not recorded at all. Under this system, some subsidiary books along with personal accounts and a cash book are kept. Under the single entry system, some transactions are completely recorded. For example, cash allocated from debtors is recorded in the debtor’s account as well as the cash account.

- Also, some transactions are partially recorded, such as cash purchases.

- We must make adjustments to the balancing figure obtained from the above statement.

- Advantages and disadvantages of both single-entry and double-entry systems.

- Incomplete records and the system followed for recording is termed as ‘Single Entry System’.

If your accounts don’t balance—total debits don’t equal total credits—you know you’ve made an error that must be investigated. Accounting, simply defined, is the method in which financial information is gathered, processed and summarized into financial statements and reports. An accounting system can be represented by the following graphic, which is explained below. The objective of preparing the statement of affairs is to estimate the balance in the capital account on a particular date. The number of assets and liabilities as of the deadline of the accounting period.

Single-Entry vs Double-Entry Bookkeeping

Transfer from debtors account to creditor’s account is debited to Creditors account and credited to Debtors account. Bad debts previously written off now recovered is not recorded in the debtors account. Accounts maintained under single entry system are recognised by income tax authorities.

Revenue must be recognized when earned and realizable, meaning generally that services have been performed, goods have been shipped, and that payment is expected. The actual payment of cash is recorded, but will not affect revenue or expense accounts at that time. Each of these accounts should have a double-entry debit and credit on your journal and ledgers. Generally, credit purchases, credit sales, Debtors Balance, Creditors Balance , etc. may be missing.

What is a Single Entry System?

If you are using software for your accounting, the program automates much of the extra effort required by the accrual method. From all the accounts balance in the ledger and any other additional details trading account, profit and loss account and balance sheet must be prepared. A Statement of Affairs at the beginning period should be prepared and open all those assets and liabilities account which have not been already opened. It is possible that some of the items, for the Statement of Affairs, are missing, such as, Debtors or Creditors or Cash-in-hand or any other items at the beginning. If it is so, one has to find them out by preparing ledger accounts .

- Absence of systematic recording of two aspects of a business transaction.

- It is very easy to ascertain profit or loss of the business under single entry system of book keeping.

- These statements and reports may be used by some third parties like bankers, investors or creditors, and are needed to provide information to government agencies, such as the IRS.

- It was earned because services were performed to satisfaction and realizable because the amounts were already billed to the client.

- At the end of an accounting period, all journal entries are summarized and transferred to the general ledger accounts.

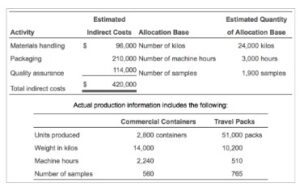

Dual aspect of a transaction is not recorded under this system. Our summaries and analyses are written by experts, and your questions are answered by real teachers. Comparison method Net worth Method statement of affair method Conversion Method.

What is single-entry bookkeeping?

Accounting students can take help from Video lectures, handouts, helping materials, assignments solution, On-line Quizzes, GDB, Past Papers, books and Solved problems. Also learn latest Accounting & management software technology with tips and tricks. It is much easier to make clerical errors in a single entry system, as opposed to the double entry system, where the debit and credit totals for separate entries to different accounts must match. Governments and regulatory agencies everywhere require businesses to keep accurate records of financial transactions. Businesses report these records periodically to tax authorities and, in the case of public companies, report also to shareholder owners.

It is important to see if all the financial operations are efficient and are actually capable of earning good profits for the business firm. For this purpose, columnar Cash Book should be prepared and all the known figures should be posted and missing items should be the balancing figure. If a combined Cash and Bank balance is given, either cash or bank may be ascertained first and, thereafter, the other by the difference between the combined figure and the figure so calculated. You are required to prepare a profit and loss account for the year ended 31st December, 1991 and a balance sheet as on that date, after making a reserve of $2,000 fro bad and doubtful debts.

Once everything is in balance, prepare a finalized balance sheet. Vi) In this system to know the total purchases and sales, one has to depend on original vouchers. Iv)This system needs very few numbers of account books and it gives only partial information. Iii) This system does not follow uniformity .It is highly flexible accounting to the capabilities Conversion Method Of Single Entry System Or Transaction Approach of individuals maintaining the records. If the adjusted value is positive then it will be the profit for that accounting year and if this value comes out to be negative then it will be treated as a loss. Preparing Statement of Affairs at the beginning and at the end of the financial year, also called Capital Conversion method or Net Worth method.

- Also learn latest Accounting & management software technology with tips and tricks.

- To have an access to the complete information, it is necessary to first complete the incomplete records using the rules of the double-entry system.

- The only requirement is that the record must have enough revenue and expense categories to meet tax reporting needs.

- We specialize in unifying and optimizing processes to deliver a real-time and accurate view of your financial position.

- In such a situation, total bills receivable account and total bills payable account are often prepared and therefore the missing figures are ascertained because of the balancing figures.

- Thus, Credit Sales or Credit Purchases may be found out by preparing Total Debtors Account or Total Creditors Account .

- Bills Receivable dishonoured is debited to Debtors account and credited to Bills Receivable.

It is based on the accounting equation that states that the sum of the total liabilities and the owner’s capital equals the total assets of the company. The conversion method involves converting your accounting from a single-entry system to a double-entry system. Small businesses usually start out by using single-entry bookkeeping. This method is a simpler way to track their income and expenses. The key advantage of the statement of affairs method is its simplicity.

Single Entry System In Accounting Vs Double Entry System In Accounting

Most individuals use the cash method for their personal finances because it’s simpler and less time-consuming. However, this method can distort your income and expenses, especially if you extend credit to your customers, if you buy on credit from your suppliers, or you keep an inventory of the products you sell. Quite often, while all details concerning bills receivable and bills payable are available but the figures of the https://quick-bookkeeping.net/solvency-definition/ bills received and bills accepted during the year aren’t given. In such a situation, total bills receivable account and total bills payable account are often prepared and therefore the missing figures are ascertained because of the balancing figures. Both statements of affairs and records show the assets and liabilities of a business entity on a specific date. However, there are some principal differences between the two.

- Given that the records are not kept under the double entry system, they are considered incomplete records.

- Open Bills Receivable and Bills Payable Account to find out acceptance received and issued or to find out closing balances for the same.

- An income statement lets you compare your single-entry and double-entry balances.

- Instead, it only indicates the incomplete nature of the records kept under this system.

- Also see formula of gross margin ratio method with financial analysis, balance sheet and income statement analysis tutorials for free download on Accounting4Management.com.

- Again, no entry is recorded in the books of accounts for any internal transactions, like depreciation on assets.

- The answer so obtained will be the profit or loss earned during the year.

Small companies can use single-entry systems without hiring a professional accountant or bookkeeper. Single-entry accounting has the significant advantage of simplicity over double-entry accounting. The positive and negative aspects of single-entry accounting are readily apparent in comparison with the alternative approach, double-entry accounting. This system is incomplete and unsystematic as it doesn’t records both the aspect of transactions. As described earlier, an opening statement of the affairs should be prepared at the beginning of the period.

Double-entry bookkeeping is a method of recording transactions where for every business transaction, an entry is recorded in at least two accounts as a debit or credit. In a double-entry system, the amounts recorded as debits must be equal to the amounts recorded as credits. Hence, these are usually referred to as accounts from incomplete records. Cash basis accounting uses the flow of cash to determine when to recognize transactions on the accounting record. Revenue earned for services will be recorded when cash is received and expenses recorded when paid out using cash or credit. The system is still double entry as the accountant uses uses two entries for each transaction so the record balances.

Which method is used under single entry system to find out the profit or loss?

Further capital introduced during the year is deducted from closing capital in order to find out the correct profit. Explanation: Under single-entry system, profit or loss is calculated by comparing capital at two dates, i.e. opening capital and closing capital (net worth method).

Total purchases by adding cash purchases and credit purchases. Financial Metrics ProKnow for certain you are using the right metrics in the right way. Handbook, textbook, and live templates in one Excel-based app.